Best Survey Types: Practices and Examples

What makes a good survey?

The goals of a good survey must be defined by the kind of survey it is; the subject matter of the survey, the audience it is targeted towards, and the information you are looking for are three places to start when framing the goals of your questionnaire.

Most companies that use questionnaires, regardless of the industry they come from, are those that cater directly to the general public, also known as consumers, rather than other businesses. In particular, big players in the tech, hospitality and service industries tend to rely heavily on customer feedback in order to improve their products and services. Even a video on-demand service like Netflix saw a vast improvement in customer satisfaction by adding a simple “thumb up or down” rating system on the movies and shows it offers. Seasoned surveyors, such as those working for think tanks and research institutes, spend a lot of time on crafting questions and ordering them appropriately in order to get the most accurate response out of people.

So let's find out the best kinds of surveys to help you get the right feedback and data you need.

Best Survey Types

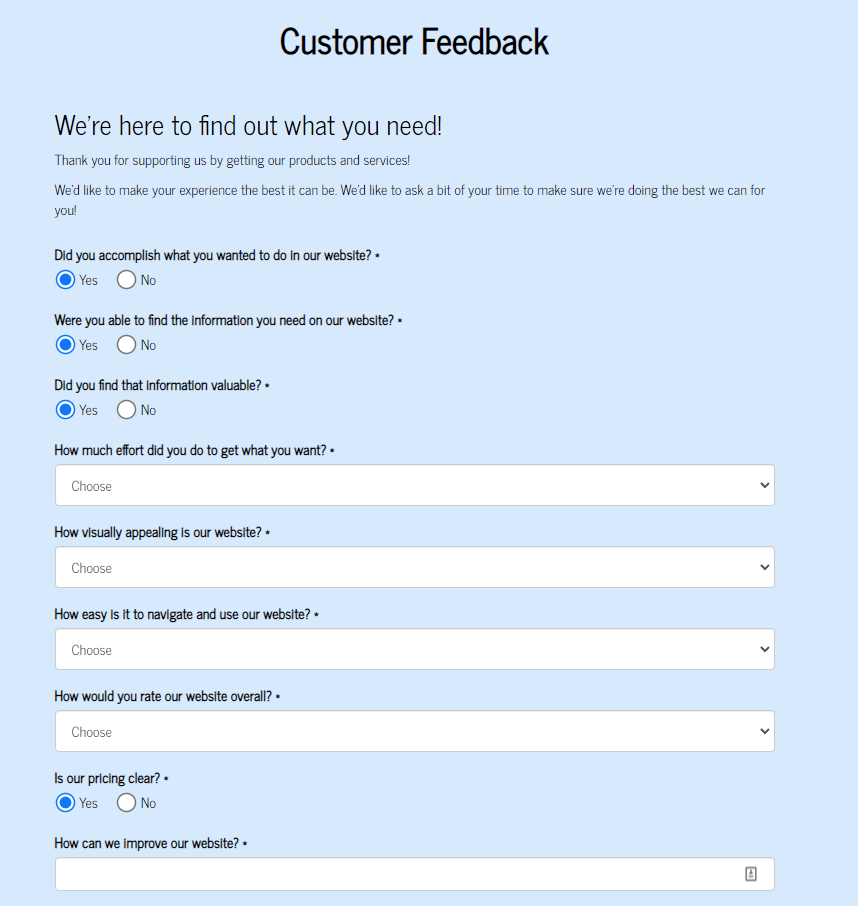

Survey #1: Customer Satisfaction Survey

One of the most common and most utilized surveys in marketing, customer satisfaction surveys are focused on the customer’s experience using a product or service, and can tell you a lot about how your target audience is responding to what you are offering. Keeping track of customer response is one of the most essential and rewarding aspects of being a creator or service provider. It may be tempting to ask a single question like “Are you satisfied with the product?”, but there are several ways of asking that question which can get you better answers. Here are some examples:

1. On a scale of 1-10 (1 being least and 10 being most), how would you rate the product?

2. How likely are you to recommend this product/service to a friend?

3. How has using this product/service helped you or given you joy?

4. How often would you like to use this product/service?

5. What did you like best about our product/service?

These surveys are a great way of gauging the success of your product or service in the market. Positive feedback is a sign to keep doing what you’re doing, while negative feedback is an instant direction to change something for the better.

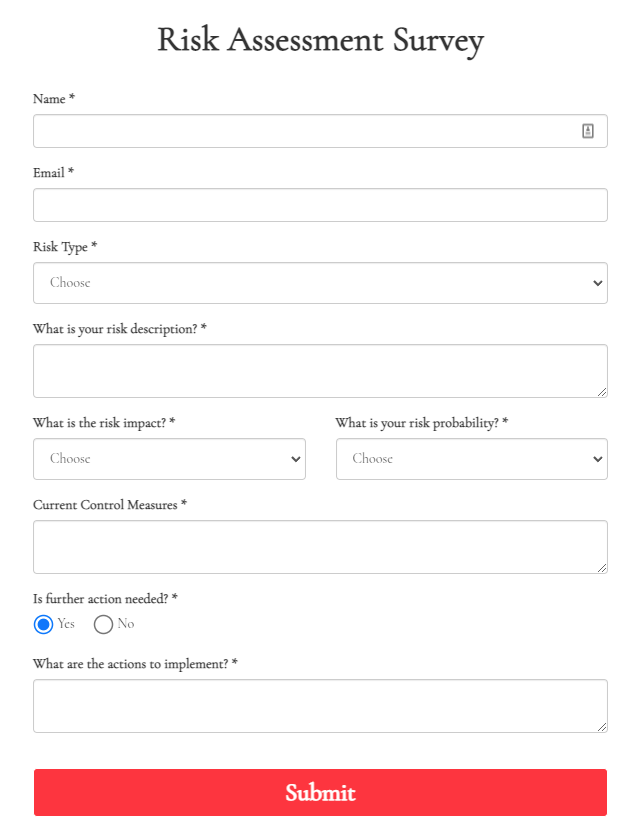

Survey #2: Risk Assessment Survey

There's always risks when it comes to business, and it's always best to foresee and analyze problems and nip them at the bud before they become a blocker to growth, both in growing your customers and establishing your service with quality goodness.

Risk assessment surveys are a great way of honing in on the potential weaknesses of an endeavor or project. Although it may not be a very palatable subject for most, risk assessment is an important aspect that must not be overlooked. These surveys can be tailored to fit nearly every situation, since prevention is better than cure no matter where you go. Here are some common questions asked in risk assessments:

1. What is the aim of the project/unit?

2. What is the biggest impediment to this aim?

3. How would you categorize this risk?

4. What is the likelihood of the risk occurring?

Risk assessment surveys can also be categorized according to urgency and the level of risk it poses to the project or unit. But it’s essential that these surveys are not ignored for too long, and given the priority that they deserve, so you can avoid damage.

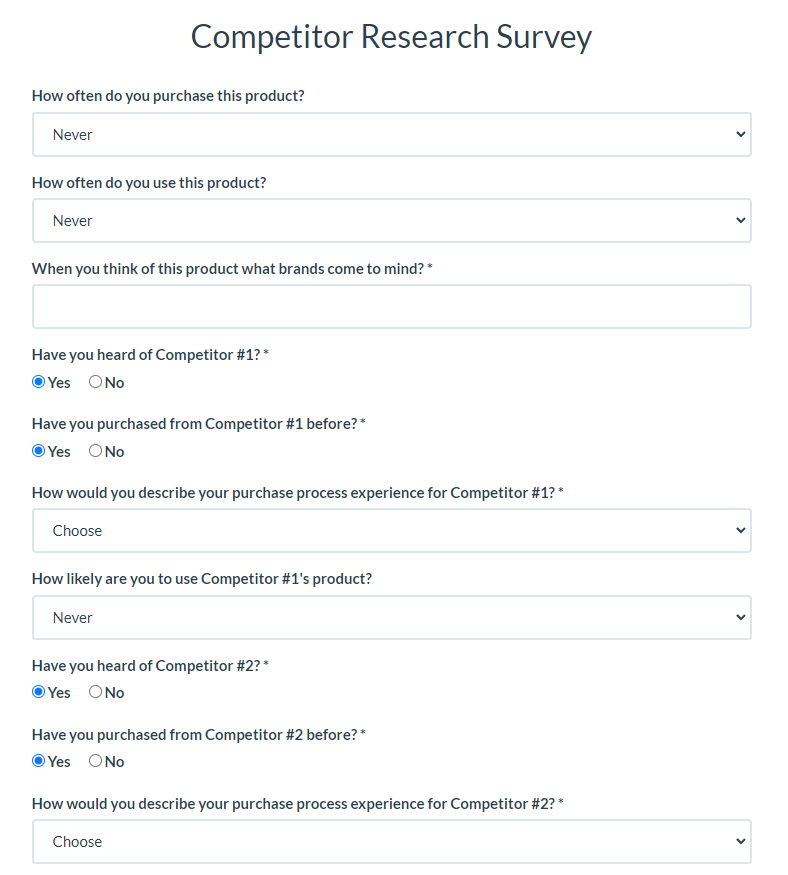

Survey #3: Competitor Research Survey

Every business owner has an additional task of keeping their competition in check and staying one step ahead at all times. While having a unique selling point that sets you apart from the rest is one way of ensuring success, understanding the competition gives you an edge that can help you stay on top. Competitor information not only gives you valuable information on the competing company, but also allows you to understand consumer behavior and trends. Here are some common questions asked on a competition research survey.

1. How have they marketed themselves? (Social media, company website, paid advertisements etc.)

2. How are their products perceived, or how are they priced?

3. Why have customers chosen to buy or not to buy from them?

4. How many ways are they accessible by, and how do these differ from each other?

The data that you collect and analyze from these surveys can go a long way in helping you optimize your own marketing strategies.

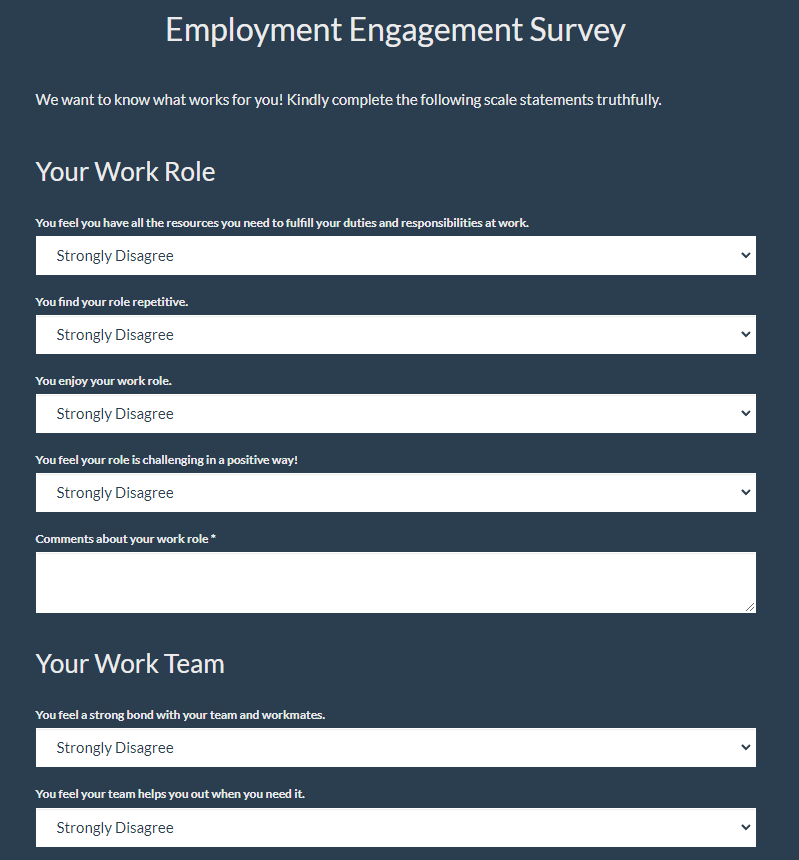

Survey #4: Employee Engagement Survey

Employee satisfaction plays a crucial role in the success of a company. The internal workings of a company are just as important as the output, and no company can survive if either one is missing. This is why keeping employees happy and making sure they feel valued in the company is essential. Many successful companies take steps to ensure that their employees feel heard, and one of the ways this is done is through a well-crafted questionnaire. Common questions on such surveys include:

1. How are your interpersonal relationships with your fellow employees and/or your superiors?

2. Do you feel like communication between you and others is effective?

3. Do you believe you are able to maintain a healthy work-life balance within the organization?

4. Do you receive constructive feedback from your managers and other superiors?

5. Are your superiors cordial and respectful when speaking to you?

Acting on the information you receive from these surveys can go a long way in boosting morale with your organization and promote financial health as well. Many companies choose to compare the results of these surveys on an annual basis to track growth.

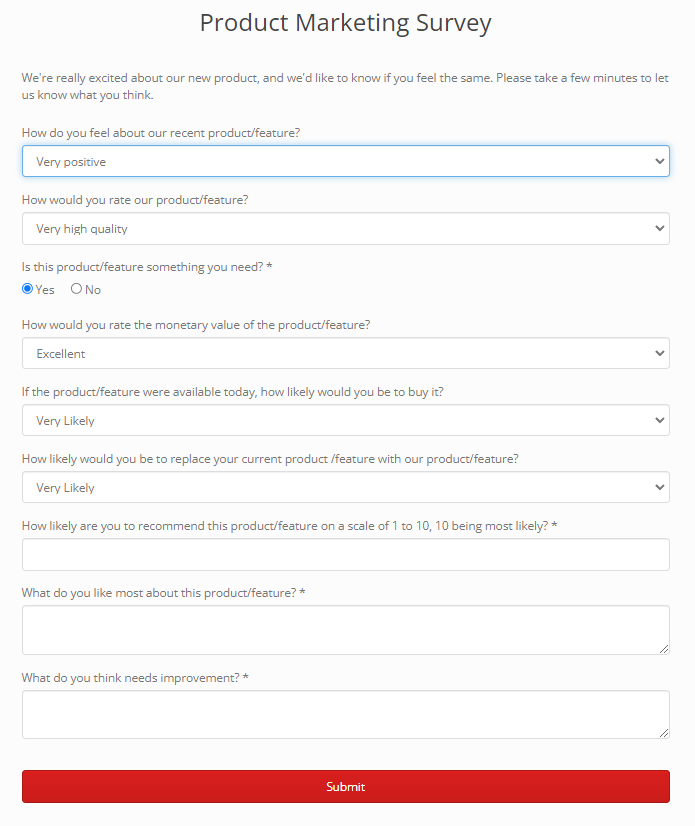

Survey #5: Product Feedback Survey

As mentioned earlier, general feedback on a product can go a long way in helping a company improve. But the information that comes from a survey entirely depends on whether the questions are framed in a way that evokes a well thought out answer from the participants. This means vague and open-ended questions such as “What did you think of our product?” are not enough on their own. Here are some examples of questions that allow for more focused information gathering:

1. How long have you been using our product?

2. What do you use our product for?

3. How often do you use our product?

4. In your opinion, what is the best aspect of our product?

5. What would you choose to improve about our product?

Further, using rating scales to record feedback on aspects of your product that you particularly wish to know more about is a good way of getting a direct opinion from the participants.

After getting the feedback you wanted, the next step is to categorize the submissions you’ve received, and then act on them accordingly. Asking demographic questions is one way to help you sort through the submissions for easier decision making. Implement the changes according to the feedback you received, and then follow up with the customers again to ensure satisfaction.

Conclusion

Regardless of the kind of survey, the first thing to do is to read what has been submitted. Every individual is unique, and each submission is a reflection of an experience which must be taken into consideration. Once you’ve gone through all the feedback, action is the next step. Seeing constructive feedback be acted upon has a positive impact on the one who submitted it, and can do wonders for the reputation of your company.